CRCs have played a key role in the translation of Australian health and medical research. Research Australia’s response to the Government’s consultation on Themes and Priorities for the CRC Programme took the opportunity to advocate for the reinstatement of Public Good CRCs, which are specifically excluded by the most recent Guidelines for the CRC Programme.

Research Infrastructure Draft Roadmap

Research Australia has provided a response to the Chief Scientist’s Research Infrastructure Draft Roadmap, released in late 2016. Research Australia’s submission has addressed the proposal for a new national advisory group, suggesting the functions of this group could be preformed by existing bodies. It has also emphasised the importance of engagement with state and territory governments in relation to investment and reiterated the importance of workforce planning for a skilled workforce to build, maintain and use research infrastructure. Research Australia has called for greater transparency in the funding of major research infrastructure and suggested some further clarity about the circumstances in which the national interest can be invoked to justify new infrastructure spending.

2017/18 Pre Budget Submission

In its pre-Budget submission to the Treasurer, Research Australia has urged the Government to remain committed to the full implementation of the National Innovation and Science Agenda, continue funding of the MRFF’s capital in accordance with the existing timetable, and emphasised the need to at least maintain real levels of funding for the NHMRC and ARC grant programs.

The submission also raises the looming issue of the funding of indirect research costs associated with MRFF grants. Research Australia has called for MRFF grants to be included as Category 1 income for universities’ Research Block Grants and for their inclusion in the IRIISS scheme for MRIs in the short term, and echoes the MRFF Advisory Board’s call for a whole of government approach to this issue in the longer term.

Public Sector Data- Productivity Commission proposes reforms

The Productivity Commission’s Draft Report on Public Sector Data Availability and Use, part of a 12 month Inquiry, has highlighted the public benefits of improving access to public data and has proposed significant reforms, including to improve access to data for researchers and to make researchers’ own data more accessible. While Research Australia is broadly supportive of the Commission’s draft recommendations, we have made substantive responses in relation to a number; particularly some that would affect the way research is conducted and funded.

As the quantities of data collected about all of us grows, so does our capacity to utilise this data for the benefit of all. As the Draft Report has identified, there is evidence that community attitudes to data and questions of privacy and security are changing, and legislation and government practices need to change to both reflect this change and enable us to harness this data as a valuable resource. Now is the time to act if we are to make the most of the opportunities public data provides to improve the delivery of government services and the health of our community, and to create the new economic opportunities and jobs of tomorrow. The Commission’s Draft Report is a very important step in what Research Australia acknowledges will be a long but fruitful journey in harnessing the transformative power of data in contemporary society.

Response to Productivity Commission Data Availability Draft Report December 2016

Fifth Mental Health Plan ignores research

Research Australia’s submission in response the draft Fifth National Mental Health Plan highlighted the Plan’s failure to include health and medical research.

Research Australia was concerned that the Fifth Plan was a missed opportunity to make better use of Australia’s significant capacity in health and medical research to help deliver the Plan’s vision of healthier Australians, faster and more complete recoveries from mental illness and more responsive and effective services.

The draft Fifth Plan called for significant reform and innovation in the way we deliver mental health services in Australia, and the health and medical research sector is well placed to help inform, design, implement and evaluate these reforms. Research Australia believes the Fifth Plan provides an opportunity to improve the integration of the mental health system with the health and medical research sector, and to better utilise and direct research towards the Plan’s priorities. Our submission highlighted some of the many ways in which health and medical research can contribute. Submission for 5th Mental Health Plan

Following Research Australia’s submission, the Fifth National Mental Helath Plan as finalised and endorsed by COAG, identifies research as a key enabler of the Plan and achieving its objectives and commits to a number of specific research related actions. The Final Plan is available here.

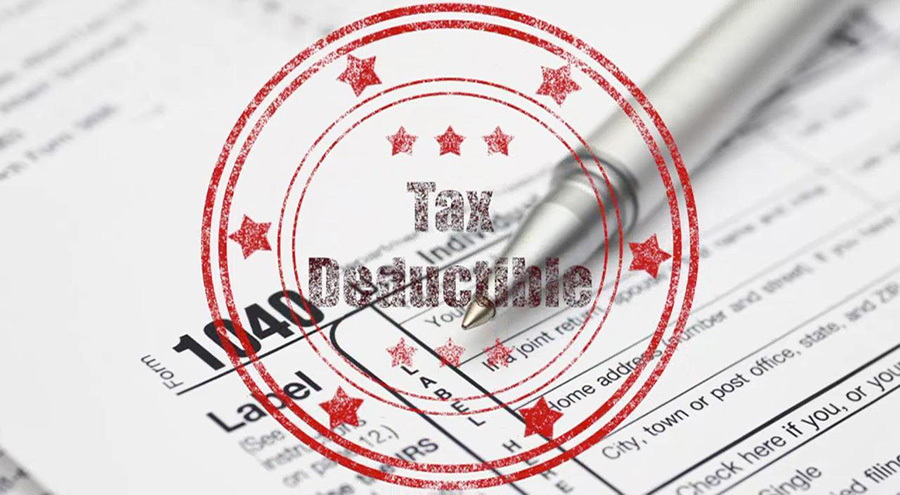

R&D Tax Incentive – Response to the Review

Research Australia has made two submissions into the federal government’s R&D Tax Incentive review.

R&D Tax Incentive Submission 2016

R&D Tax Incentive Submission 2015

Research Australia supports the report’s recommendations to:

- maintain the current eligibility criteria

- introduce an incentive to encourage collaboration with publicly funded researchers

- to release more information about claimants.

Research Australia has opposed the application of a new $2 million cap to small caps that are seeking to commercialise HMR and proposed a modification to a recommendation that would limit the R&D Tax Incentive to more research intensive companies.

The Government will now consider the recommendations of the Review together with the responses from the public consultation and then formulate its response, which is expected to be subject to another round of consultation, probably early next year.

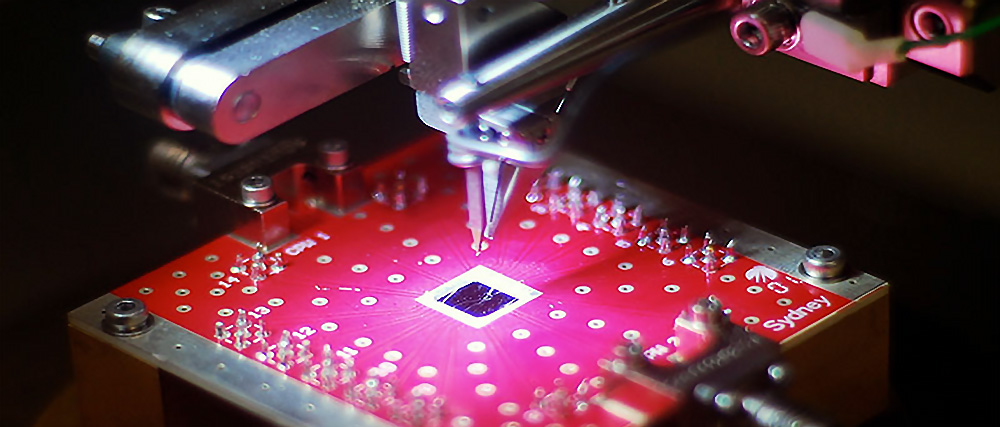

Roadmap for Research Infrastructure

Research Australia has responded to the Capability Issues Paper provided as part of the development of a new National Research Infrastructure Roadmap. The Roadmap will guide the Australian Government’s future investment in large national research infrastructure.

Research Australia’s submission supports the consideration of international participation in Australian facilities and Australian participation in international facilities as part of the process of evaluating new research infrastructure facilities. We have supported the proposed governance principles and suggested that specific governance arrangements need to be fit for purpose for the individual proposal rather than fitting a predetermined template.

Research Australia has emphasised the importance of broadening the governance frameworks in relation to data infrastructure to consider the issues raised where the data is individuals’ health information, and made the point that legislative and cultural barriers to the better use of data need to be addressed in tandem with technological solutions.

The need to consider workforce training and capability issues as part of the broader roadmap was endorsed, as was the need to consider the full infrastructure lifecycle.

R&D Tax Incentive- proposed reduction opposed

As part of the Budget Savings (Omnibus) Bill 2016, the Government has once again introduced a measure to reduce the rate of the R&D Tax Incentive by 1.5%. Research Australia has made a submission to the Senate Economics Legislation Committee opposing this measure, as we have done previously.

The reduction will have the greatest impact on small companies who are in receipt of the refundable tax offset. While the 1.5% reduction is intended to reflect the recent reduction in the tax rate for small companies and is there supposedly ‘tax neutral’ the reality is that these small research intensive companies are running at a loss and not paying tax, so they will be adversely affected. Large companies will also be adversely affected because the mooted tax reductions for large companies have not yet been legislated.

The Government has yet to release the report of the Review it commissioned in 2015 into the operation and effectiveness of the R&D Tax Incentive.

Review of NHMRC funding programs

The NHMRC CEO Professor Anne Kelso has appointed an Expert Advisory Group to provide advice and assistance to the NHMRC in undertaking a Review of Funding Programs. A Consultation Paper was issued in July and was followed by a series of public forums in August.

Research Australia has made a submission in response to the Consultation Paper supporting the proposal for two streams of grants, one which emphasises the researchers’ track record and the other on the research proposal. The submission proposes that the limit on the number of Chief Investigators be removed and does not support a fixed duration of 5 years for grants. Research Australia supports the proposal for early career people grants with a research component, and recommends that a Fellowship Program independent of Team or Investigator grants be retained, particularly for researchers who participate in and support multiple research projects and would be adversely affected by the proposed caps on the number of grants a person can apply for or hold.

Public Sector Data Availability and Use

The Productivity Commission is undertaking an Inquiry into the availability and use of public data. Research Australia’s submission in response to the Issues Paper emphasises the importance of improved access to public data as a means of facilitating Australian health and medical research. It highlights the importance of linked datasets and identifies a number of cultural and legislative barriers to the greater use of data for research purposes. It also provides some case studies and makes some recommendations for improvement.